The price of Bitcoin, the most famous cryptocurrency in the world, continues to rise. Given several factors, this increase could well continue.

Bitcoin broke its all-time price record on March 5, 2024, crossing the $69,000 mark for the first time. Despite an impressive drop in value in the immediate aftermath, the cryptocurrency quickly recovered – and appears to be doing better than ever.

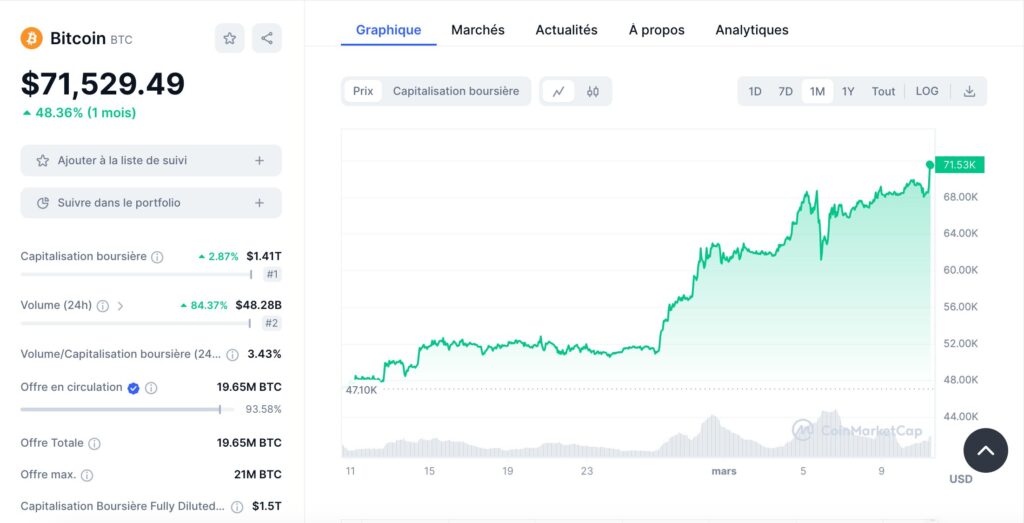

After breaching the $70,000 mark over the weekend, Bitcoin was trading around $71,500 on Monday, March 11, 2024, setting a new record high. Impressive numbers that take the entire cryptocurrency sector with them – and that could last.

Bitcoin prices that could rise further

In 2021, when Bitcoin reached its previous record high of $68,789, the joy didn’t last and the cryptocurrency immediately began a very long descent. In a few months, its price dropped by 50%. Bitcoin also took the entire cryptocurrency market with it, which fell very strongly in 2022 and part of 2023. This period has been described as a bear market, a bear market very unsuitable for investment, and ended only recently when the price of Bitcoin rose.

The era that is beginning to dawn is a bull market – a market that is the opposite of a very optimistic bear market that should see the entire cryptocurrency sector increase in value. We can already see that the new records for Bitcoin have taken all other cryptocurrencies with them: the whole market is on the rise, and ether – the second cryptocurrency in terms of capitalization – is at $4,000, two fingers away from breaking its all-time record. .

However, the bull market is not the only one responsible for the good health of the crypto market. Three other factors determine and drive the entire sector:

- arrival of bitcoin ETFs on the market: ETFs, or Exchange traded funds (exchange-traded funds, in French), are financial products that mimic the performance of other stock market assets. In the case of Bitcoin, ETFs allow you to have the same returns without having to buy cryptocurrencies. However, these ETFs, approved by the US authorities in early 2024, are extremely popular. Such is the demand for these funds that they have driven up the entire price of Bitcoin and their popularity doesn’t seem to be waning.

- the upcoming arrival of the halving: every four years the bitcoin halving will shake up the cryptocurrency. This is the time when the rewards given to miners are halved, making bitcoins more scarce and mechanically increasing prices.

- market optimism: the last thing to consider is the good mood of the markets, which generally rhymes with rising rates. This also applies to the crypto market, which is positive after the bear market. ” The mood in companies is much more positive than a year or two ago », expert Claire Balva noted a few weeks ago in an article in Numerama. Add to that rumors of an ECB interest rate cut (which generally means more investment) and the sector is decidedly bullish.

With all this good news, it’s no wonder Bitcoin is taking off so much and its rise continues. Observers estimate that bitcoin could soon surpass $100,000 — a dream that has long seemed unattainable but could soon become a reality.